Complexity and Responsibility: By having an SDIRA, you may have far more Management above your investments, but You furthermore may bear additional duty.

As an investor, on the other hand, your choices usually are not limited to stocks and bonds if you select to self-direct your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Relocating funds from a person variety of account to another form of account, for instance shifting cash from a 401(k) to a traditional IRA.

A self-directed IRA is undoubtedly an amazingly powerful investment car or truck, nevertheless it’s not for everybody. As the expressing goes: with great electricity arrives great accountability; and with the SDIRA, that couldn’t be more correct. Continue reading to master why an SDIRA may, or may not, be in your case.

IRAs held at banks and brokerage firms supply constrained investment selections for their purchasers because they do not have the expertise or infrastructure to administer alternative assets.

The principle SDIRA guidelines from the IRS that traders will need to be familiar with are investment limitations, disqualified folks, and prohibited transactions. Account holders must abide by SDIRA procedures and restrictions as a way to maintain the tax-advantaged standing in their account.

Though there are many benefits connected with an SDIRA, it’s not without the need of its own drawbacks. A number of the frequent main reasons why buyers don’t pick out SDIRAs involve:

Making the most of tax-advantaged accounts allows you to continue to keep additional of the money that you spend and receive. According to regardless of whether you end up picking a conventional self-directed IRA or perhaps a self-directed Roth IRA, you've the possible for tax-free of charge or tax-deferred development, presented selected situations are satisfied.

Constrained Liquidity: Most of the alternative assets that may be held in an SDIRA, which include housing, non-public fairness, or precious metals, might not be effortlessly liquidated. This may be a concern if you must access resources speedily.

Property is among the most well-liked options among the SDIRA holders. That’s due to the fact you could invest in any sort of real estate having a self-directed IRA.

No, You can't spend money on your own private small business by using a self-directed IRA. The IRS prohibits any transactions between your IRA along with your have enterprise as you, given that the proprietor, are regarded a disqualified particular person.

As you’ve identified an SDIRA company and opened your account, you may well be questioning how to actually start off investing. Being familiar with the two The principles that govern SDIRAs, and also ways to look at more info fund your account, can help to lay the muse for a way forward for profitable investing.

Numerous buyers are stunned to find out that applying retirement resources to speculate in alternative assets is attainable due to the fact 1974. Even so, most brokerage Discover More firms and banks deal with supplying publicly traded securities, like stocks and bonds, as they absence the infrastructure and abilities to handle privately held assets, including housing or non-public equity.

Homework: It is really termed "self-directed" for just a motive. Having an SDIRA, you will be fully to blame for carefully exploring and vetting investments.

Believe your friend is likely to be starting off the following Fb or Uber? With the SDIRA, you can put money into causes that you think in; and potentially delight in higher returns.

Whether or not you’re a fiscal advisor, investment issuer, or other financial Skilled, take a look at how SDIRAs can become a robust asset to develop your organization and achieve your view Expert objectives.

Shopper Help: Try to find a provider which offers committed assistance, like use of experienced specialists who will remedy questions about compliance and IRS rules.

This consists of understanding IRS rules, running investments, and keeping away from prohibited transactions that could disqualify your IRA. A lack of knowledge could end in costly blunders.

In the event you’re looking for a ‘set and forget’ investing technique, an SDIRA most likely isn’t the appropriate decision. As you are in total Command about each individual investment built, It really is up to you to perform your personal homework. Keep in mind, SDIRA custodians are not fiduciaries and can't make recommendations about investments.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Hailie Jade Scott Mathers Then & Now!

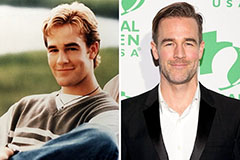

Hailie Jade Scott Mathers Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!